By Samuel Armes

Politics Not Policy

Understand this: Desantis has used Florida policy to control the media cycle and show how he will run the rest of the country. He may not have a popular twitter account, but he has used his actions to aggressively pursue an agenda that is the complete opposite of what we are seeing in D.C. To understand the Anti-CBDC Bill, you must first understand that is a political play first, and a policy play second.

Desantis’ Anti-CBDC bill put him on the forefront of “Freedom & Liberty” based policies, showing that he does not support an authoritarian surveillance state. It is no coincidence that his press briefing podium sat under a giant screen that said “Big Brothers Digital Dollar.”

The message is clear: Desantis administration is going to pass legislation that stops any implementation of a CBDC in Florida. Soon after this legislation is passed, I am certain the Federal government will sue Florida upon implementation of a CBDC, whenever that might be. Desantis and his team know this.

Lets look at Florida’s legal standing in preparation for such a lawsuit.

Step 1: Define The Playing Field

Every bill in Florida has a staff analysis that is released that describes the intent, purpose, and legal justification for a bill. The staff analysis for the Anti-CBDC Bill starts by defining Florida’s view of a CBDC.

Defining Digital Currency | CBDC’s are NOT Bitcoin

The analysis states that Desantis and his team has an issue with the idea that a CBDC is the only form of money. The ULC’s language would mean that a CBDC issued by the Fed would have to be considered money, and thereby must be accepted by anyone within the U.S.

Given that CBDC’s could violate constitutional rights, Desantis is trying to separate CBDC’s from money. This set up the idea to ban CBDC’s without enacting a ban on money.

“Digital currency is a virtual representation of a value that is not available in physical form but which can be used as a medium of exchange, a unit of account, or a store of value. Digital currency is stored and transacted in electronic form and does not have the status of U.S. currency in any U.S. jurisdiction.”

“Digital currency includes a subset of currencies referred to as cryptocurrencies (i.e., Bitcoin) which are protected by cryptography. Central bank digital currency (CBDC) is a digital currency authorized by a sovereign central bank or government as a digital representation of a certain denomination of currency.”

The Analysis further States:

“Digital currencies can be issued in two ways: decentralized and centralized. Most privately issued digital currencies, such as Bitcoin, belong to decentralized digital currencies, while central bank digital currencies (CBDCs) are centralized currencies issued by central banks.”

“Some specific characteristics of a CBDC include:

- Liability of the central bank or government that authorizes and/or issues the CBDC;

- Issuance directly to consumers (i.e., circumventing the intermediary role of commercial banks);

- Usage of distributed ledger technology (such as blockchain) that allow computers in different locations to propose and validate transactions and update records in a synchronized way across a network.”

Desantis separates a CBDC from something like Bitcoin. A CBDC must come from a “Sovereign central bank or government.”

They also wisely note that with a CBDC, there is no need for a bank. Why need a bank when everyone is connected directly to the Federal Reserve through an app?

The analysis further states:

“In other words, the definition of “money” in the UCC model amendments excludes digital currency, unless such digital currency has been authorized or adopted by the federal government.

In effect, the UCC model amendments open the door for the implementation of U.S. CBDC while excluding any other digital currency not issued by a centralized bank that has not been adopted by the government (i.e., Bitcoin or the like, cannot be elevated to the status of money). These suggested model amendments have not been adopted by Florida.”

CBDC’s Are Not Necessary and Would Change Governments Role In Society

Desantis Anti-CBDC Bill also states that there is no need for a CBDC. Most money is already digital and the economic efficiencies of CBDC’s are overstated.

“In the U.S. today, standard U.S. currency is the only type of central bank money available for use by the general public. Proponents of CBDC claim it would accomplish goals of financial inclusion and promoting the U.S. currency’s international role as a reserve currency and a medium of exchange for international trade. However, the issuance of a CBDC would rewire the fundamental infrastructure of America’s banking and financial system by changing the relationship between citizens and money.”

“While the Federal Reserve has made no decisions on whether to pursue or implement a CBDC, the Uniform Law Commission (ULC) and American Law Institute (ALI) have drafted model amendments to the Uniform Commercial Code to address emerging technologies and provide updated rules for commercial transactions involving virtual currencies, distributed ledger technologies (including blockchain), and other technological developments. These suggested model amendments have not been adopted by Florida.”

Legal Background

The legal background on the Federal Level is ultimately where the lawsuit would come into play, and this is exactly why such laws are mentioned in the staff analysis:

- In 1792, Congress passed the Mint Act which established the coinage system of the United States and dollar as the principal unit of U.S. currency. The first U.S. coins were struck in 1793 at the Philadelphia Mint, and the first paper money was issued in 1861.

- In the interim years, the U.S. government issued “Treasury notes” intermittently during periods of financial stress, such as the War of 1812, the Mexican War of 1846, and the Panic of 1857.3

- In 1913, Congress passed the Federal Reserve Act, establishing America’s Federal Reserve System and authorized the Federal Reserve Banks to issue Federal Reserve Bank notes, which they began issuing in 1914.

- The first electronic payment was made in the 1871, when Western Union debuted the electronic fund transfer system. Money serves as a medium of exchange, a store of value, and a unit of account.

In the U.S. today, money takes multiple forms:

- Central bank money is a liability of the central bank. In the U.S., central bank money comes in the form of physical currency issued by the Federal Reserve and digital balances held by commercial banks at the Federal Reserve.

- Commercial bank money is the digital form of money that is most commonly used by the public. Commercial bank money is held in accounts at commercial banks.

- Nonbank money is digital money held as balances at nonbank financial service providers. These firms typically conduct balance transfers on their own books using a range of technologies, including mobile apps

Situational Awareness

As stated above, Desantis and his team are well aware of the legal fight this bill will trigger. A legal fight would further boost Desantis profile on the national stage, and continue to make him the center of attention.

The Bill analysis quotes the very Constitutional issues they are prepared to challenge.

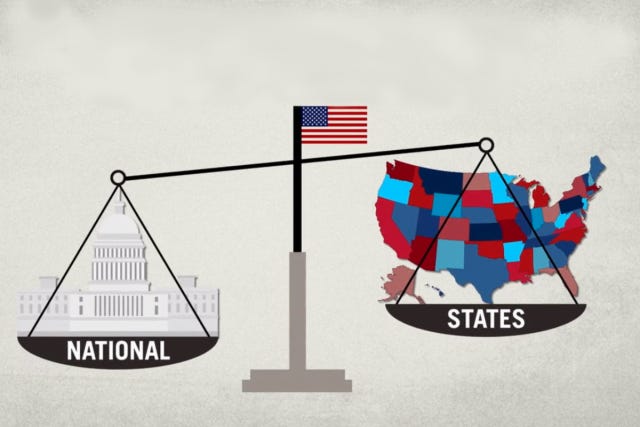

The first is the Constitutions Supremacy Clause:

“The Constitution’s Supremacy Clause provides that federal law is ‘the supreme Law of the Land’ notwithstanding any state law to the contrary. This language is the foundation for the doctrine of federal preemption, according to which federal law supersedes conflicting state laws.”

The second is the Dormant Commerce Clause:

“In contrast to the doctrine of preemption, which generally applies in areas where Congress has acted, the so-called Dormant Commerce Clause may bar state or local regulations even where there is no relevant congressional legislation. Although the Commerce Clause is framed as a positive grant of power to Congress and not an explicit limit on states’ authority, the Supreme Court has also interpreted the Clause to prohibit state laws that unduly restrict interstate commerce even in the absence of congressional legislation—i.e., where Congress is dormant. [… Under the Dormant Commerce Clause,] states may not take actions that are facially neutral but unduly burden interstate commerce.”

Conclusion

There is a simple logic to bold State legislation like Desantis’ anti-CBDC bill: Sue me.

Whether Desantis has the authority to ban CBDC’s or not does not matter. Politics is about power. When you don’t have power, slow down the process.

If multiple states pass similar legislation, the lawsuits could slow down any CBDC implementation in time for a 2024 Presidential change. Further, Florida being sued by the Federal government would only embolden Desantis’ 2024 trajectory.

The Anti-CBDC fight is one worth fighting, through both policy and politics. The question remains: who will follow Desantis’ lead?

Sources:

The Anti-CBDC Bill: https://www.myfloridahouse.gov/Sections/Documents/loaddoc.aspx?PublicationType=Committees&CommitteeId=3220&Session=2023&DocumentType=Proposed%20Committee%20Bills%20(PCBs)&FileName=PCB%20COM%2023-02.pdf

The Florida Staff Analysis: